Pearl Payments Reviews & Complaints

| Pros: | Cons: |

|---|---|

| No need for extra equipment. | Limited product offerings. |

| Low complaints overall. | Difficulty in reaching customer service. |

| Simple setup and cost management. | Unexpected fees reported. |

| Dependable customer service. | Lack of information on additional fees. |

| Advanced technology for business efficiency. | Some negative customer experiences. |

Overview

In this review of Pearl Payments, we will take a detailed look at this payment management software designed to streamline handling both one-time and recurring payments for businesses. With a focus on automation, Pearl Payments simplifies credit card and ACH deposit transactions, aiming to reduce the time spent on collections. However, it's not just about efficiency; we also explore potential pitfalls, examining common customer complaints, contract terms, and challenges with customer service.

We will analyze Pearl Payments in the context of the wider payment processing industry, considering its rates and fees and how they compare to competitors. For businesses thinking about adopting Pearl Payments, this review offers a balanced view, highlighting both the advantages and areas where caution is needed. Lastly, we will delve into the company's background, including the enigmatic status of its developer, Swing Set Labs, to provide a well-rounded perspective on this potentially transformative tool.

About Pearl Payments

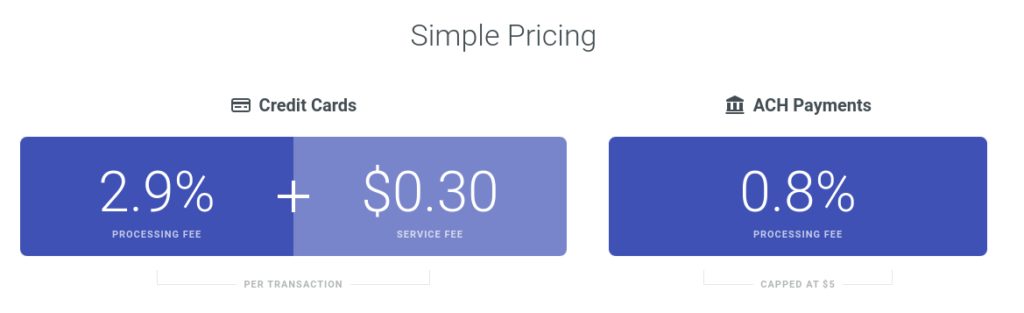

Pearl Payments is a payment management software that has been developed to enable a merchant account to automate its recurring payments made by credit card or ACH deposits. Additionally, the company also allows clients to charge one-time payments. The interface allows users to minimize the amount of time they spend on collections. In addition to automation, Pearl Payments also helps merchants keep their customer's information up to date and notifies them of missed payments and past-due balances. Pearl Payments was developed by Swing Set Labs, which may be out of business.

Pearl Payments Products and Services

Payment Processing

Pearl Payments provides a payment management platform that facilitates the collection and management of payments for businesses. This service supports both one-time and recurring payment options.

Automation Features

The platform includes features that allow businesses to automate recurring payments through credit card or ACH deposits, reducing the time spent on managing collections.

Pearl Payments Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | No |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Clarifying Complaints Against Pearl Payments

Our research reveals few negative reviews specifically targeting Pearl Payments, with a handful noted in the comments section below. It’s important to distinguish that this company shares its name with another entity known as Pearl Payments, leading to some confusion and misdirected critiques. The Pearl Payments discussed in this profile proactively addresses instances of mistaken identity, clarifying any misunderstandings. We encourage you to share your experiences with Pearl Payments in the comments to help distinguish between the two entities.

Legal Status of Pearl Payments

No significant class-action lawsuits or Federal Trade Commission (FTC) complaints have been discovered against Pearl Payments. Clients seeking resolutions without litigation might find value in contacting appropriate oversight organizations.

Customer Support Insights for Pearl Payments

Pearl Payments provides limited contact options for customer support via its website, offering a general email address at [email protected] for inquiries. This approach does not meet the industry standards set by leading payment processors known for exemplary customer service. Despite a commendable record in handling complaints and maintaining a clean legal slate, the scarcity of direct customer support channels contributes to a “B” rating in this area.

This update aims to offer a nuanced perspective on Pearl Payments, highlighting user feedback, legal standings, and the state of customer support while incorporating SEO-optimized terms related to “reviews,” “complaints,” and “customer service.” These enhancements are designed to improve the article’s visibility and usefulness for individuals researching Pearl Payments.

Pearl Payments Online Ratings

Here's How They Rate Online

| BBB Reports | 2 |

|---|

Under 5 Complaints

Pearl Payments is not accredited with the Better Business Bureau and currently has an “A+” rating with the BBB. The company has received 2 complaints in the last 3 years.

An “A” Performance

Considering the low number of complaints and good resolution rate, we agree with the BBB’s score at this time.

Pearl Payments Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

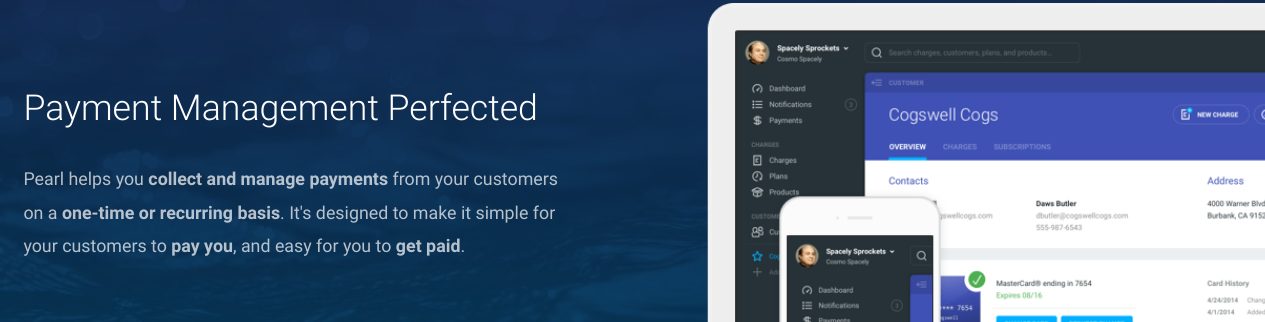

| Processing Rates | 2.90% + $0.30 |

| Monthly & Annual Fees | Unclear |

| Equipment Lease Terms | No |

Variable Rates for Different Payment Methods

Pearl Payments displays a flat fee structure of 2.90% plus $0.30 for card transactions, accompanied by a 0.8% transaction fee for ACH payments. However, additional contract terms such as monthly fees, setup fees, contract duration, PCI compliance fee, or an early termination fee are not listed on the company’s website.

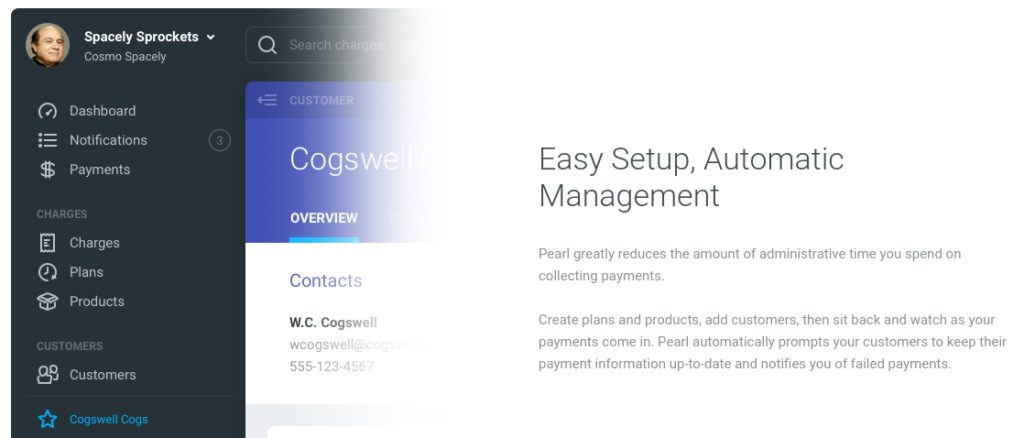

No Need for Extra Equipment

Pearl Payments advertises its services through a virtual terminal. While the company highlights its focus on recurring payments, it also mentions its capability to process one-time payments. Utilizing a virtual terminal for one-time payments eradicates the necessity for businesses to engage in long-term equipment leases since this interface operates on a business’ computer or through a compatible mobile app.

Overall Rating of “A”

Based on the available information, Pearl Payments receives an “A” rating in this segment. This assessment stems from the transparent disclosure of Pearl Payments rates for credit card and ACH payments. Nevertheless, businesses contemplating the service should seek clarity regarding any potential additional fees.

Details on the Pearl Payments payment gateway

Pearl Payments Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

No Independent Sales Agents

Pearl Payments does not hire independent sales agents or operate an affiliate program. There are no Pearl Payments reviews or online reviews that make mention of any issues with the company’s inside sales practices either. This compares favorably to our list of best credit card processors.

Clear Rates

The Pearl Payments website clearly lists the fees that it charges for both credit card and ACH payments made to businesses. However, the company’s website does not list whether or not clients utilizing the service must enter into any contract or if there are any additional monthly Pearl Payments fees, set-up fees, or early termination fees.

A “B” Overall

Given the company’s clear rate disclosure along with insight into other features its service offers, Pearl Payments receives a “B” in this category. The lack of information about any additional contract terms and fees is the sole reason its grade is not higher.

Our Pearl Payments Review Summary

Our Final Thoughts

Pearl Payments, a relatively small player in the credit card processing industry, specializes in providing merchant accounts and credit card processing services. Recently, there has been a noticeable uptick in customer complaints, primarily focusing on customer service that is hard to reach and unexpected fees that have begun to emerge predominantly over the last year.

Aside from these concerns, Pearl Payments specifically targets its services towards businesses that require recurring billing capabilities, such as those offering subscriptions, memberships, or regular monthly billing, in addition to providing traditional point-of-sale (POS) options. This focus indicates a specialization that could benefit certain business models, particularly those in need of structured recurring payment solutions. However, given the recent concerns raised by customers, business owners are strongly encouraged to meticulously review their service agreement with Pearl Payments before establishing a merchant account.

Location & Ownership

Pearl Payments was developed by Swing Set Labs, which described itself as a product incubation company powered by Bust Out, though it’s no longer clear if the business is operating. Swing Set Labs is headquartered at 514 N Third St, Suite 105, Minneapolis, MN. Pearl lists their headquarters at 5720 LBJ FWY Suite 610 Dallas, TX 75240. The Swing Set Labs headquarters shares its address with Bust Out, whose founder and CEO is Jeff Lin.

If you found this article helpful, please share it!

MIKE SALEH

DO NOT SIGN-UP, BEWARE!!!!

THEY ARE FRAUD COMPANY THAT WILL SIGN YOUR LEASE FOR MERCHANT PROCESSING MACHINE WHICH YOU CANNOT CANCEL EARLY. THEY HAD ME LOCKED ON 4 YEAR LEASE FOR A MACHINE THAT I AM NOT USING AND WHEN I CALLED TO CANCEL. THEY SAID I HAVE TO CALL THIRD PARTY TO CANCEL.

RATES ARE HIGH, MACHINES ARE REALLY SLOW AND NEVER WORKED, AND LOCK YOU INTO PAYING FOR EQUIPMENT BY PUTTING YOU LEASING IT TO YOU.

Candace Farris

BUYER BEWARE! DO NOT USE THIS COMPANY! From not paying our early termination fees as they promised they would, to charging us WAY MORE monthly than we had been paying in processing fees, to not being able to get in touch with anyone, to having to pay early termination fees again to get out of the lease with Ascentium when we finally left Pearl(after paying early termination fees when we left our previous processor that we never received reimbursement for), to being bounced from one employee to another…this company is a nightmare! We ended up being out right around $7,000 in fees and overcharges that they miraculously never could do anything about, although they were “looking into it” the entire time. When we first signed up with them they couldn’t get us a machine that would work. This was right at the beginning of the pandemic. We were charged for 6 months(including non-use fees as we weren’t processing any payments through them). Those 6 months of fees were never reimbursed although it was their fault we couldn’t process during this time! What this company does should be criminal! I should have read reviews on them before we switched. They sent a salesman to our company, we did not seek them out. They were a nightmare from the beginning.

Donna Irish

I have been trying to contact them for my account for weeks. every number including customer service goes to voice mail which is ok but not if they all have full mail boxes. going to stop automatic payment see how fast they get incontact with me then.

Debbie Ferguson

When I started working with Pearl Payments I did not know very much about POS companies or products. After several months I received a Clover mini. This did not work as it was too small. After several more months I finally received an EHopper. Keep in mind, each of these companies use a different credit card processing company. The EHopper was way too big so again, after several months I finally received the E500 Pax. Perfect size, works great.

The problem is that now one cancelled the credit card processing contracts that went with the Clover and EHopper. Although I had no choice, these companies will not cancel. They are 48months term. I have called Pearl, written Pearl, left voicemails. I have been promised that it will be taken care of, but to date, I am still paying over $300 to credit card processing companies I not longer are using.

I will be filing a complaint and cancel all business dealing with Pearl.

DO NOT DO BUSINESS WITH THIS COMPANY! THEY WILL SELL YOU SOMETHING AND THEN IGNORE YOU!

Catherine McWhinnie

Could you help me get in contact with John Sarkisian? Thanks

Colin Qian

This is not an honest company. There are fees that are not disclosed at the agreement signing. They don’t honor what they promise to do like a free trial. Also I just noticed that they could alter the contents of the agreement you signed off. And the worst is their merchant support. For legitimate issues and concerns, they ignore your calls and emails, not willing to help you resolve them.

Colin Qian

This is a follow-up to my review on October 19, 2019.

I want to commend Mr. John Sarkissian, Director of Operations, for reaching out to me and trying to address my concerns. I got sold a plan that didn’t meet the goal of saving card processing fees using a second payment system at my store. There were also fees that were not communicated to me when I signed up. John was willing to address my concerns. Now I’m on a different plan that he thinks would work for me. For his efforts, I would recommend Pearl Payments. Also I really like the smart terminal they have, Poynt. It is flexible in that it has apps to allow different plans to meet different customers needs.