Moolah Reviews & Complaints

Overview

In this review of Moolah, we will provide a detailed overview of the company's credit card processing services. We will cover the range of services they offer, including point-of-sale (POS) systems, mobile payment solutions, and e-commerce capabilities. The review will identify the types of businesses that might benefit from these services. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, contract terms, and specific services provided. By the end of this review, you will understand whether Moolah meets your payment processing needs.

About Moolah

Founded in 2011, Moolah is a merchant account provider that sells mobile and desktop payment processing apps integrated with Authorize.Net's payment gateway and Poynt terminals.

Moolah Products and Services

Payment Processing

Moolah Poynt terminals are compatible with EMV, NFC, magnetic strip, gift card, EBT, credit, and debit transactions. The company also offers Quickbooks integration for its payment gateways and terminal services. While Moolah acts as a payment processor, its software relies on Authorize.Net to facilitate payment acceptance through computers and mobile devices. It is important to note that Moolah is not associated with a similarly named cashback service, despite potential confusion.

Moolah Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

Low Complaint Total

Our search finds only two negative Moolah reviews, with neither labeling the company as a scam. One review mentions a delayed payment, and the other cites poor customer service. These appear to be isolated cases and haven’t significantly impacted Moolah’s overall rating. If you’ve had an experience with Moolah, feel free to share your review in the comments below.

Moolah Lawsuits

No class-action lawsuits or FTC complaints have been reported against Moolah. Merchants looking for non-litigious ways to resolve disputes might find it useful to report their concerns to supervisory organizations.

Moolah Customer Service Options

Moolah offers phone support and also provides a website support form, but it’s important for merchants to know that issues related to the payment gateway might require contacting Authorize.Net directly. The following customer service contact is available:

(800) 625-1670 – Toll-Free General Customer Service

While Moolah doesn’t have a specific email support address, they do provide a support form on their website.

Despite these provisions, Moolah does not rank as a top choice for exceptional customer service in the industry.

Moolah Online Ratings

Here's How They Rate Online

No Profile

The Better Business Bureau does not maintain a profile for Moolah at this time. We therefore will not factor a BBB rating into this review.

Moolah Fees, Rates & Costs

A Closer Look at The Contract

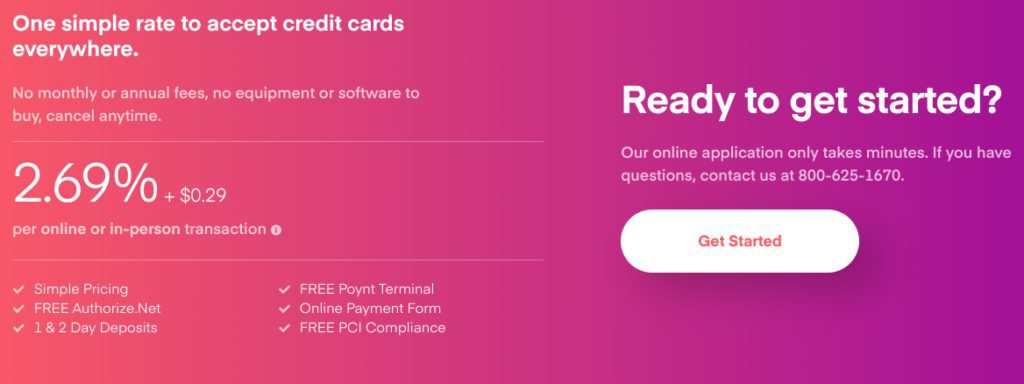

| Swiped Rate | 2.69% + $0.29 |

|---|---|

| Keyed-in Rate | 2.69% + $0.29 |

| Virtual Terminal Rate | 2.69% + $0.29 |

| Payment Gateway Fee | None |

| Minimum Processing Fee | $19.95 or $99.95 Per Month |

| Chargeback Fee | $25 |

| Early Termination Fee | $0 |

| PCI Compliance Fee | $0 |

| Equipment Lease Terms | None |

Month-to-Month, No Termination Fee

Moolah offers a flexible month-to-month merchant account contract with competitive rates of 2.69% plus $0.29 per transaction. For e-commerce accounts utilizing the Authorize.net payment gateway, there is a monthly minimum fee of $19.95, while in-store accounts equipped with a complimentary Poynt terminal have a monthly minimum of $99.95. Additionally, a chargeback fee of $25 is applicable. Moolah also assures that there are no PCI compliance or early termination fees involved.

Virtual Terminal and Payment Gateway Pricing

Through its partnership with Authorize.Net for online payments, Moolah states that its merchants are exempt from Authorize.Net’s standard $49 setup fee and $25 monthly gateway fee. The transaction rate provided by Moolah, 2.69% plus $0.29, presents a modest savings compared to Authorize.Net’s usual rate of 2.90% plus $0.30.

Save On Rates, Pay More Fees

While Moolah’s transaction fees are slightly below the industry standard, the monthly minimum fees may offset these benefits for merchants with lower transaction volumes. For businesses processing a moderate to high volume of sales each month, Moolah’s cost efficiency improves, potentially offering more savings than some budget merchant accounts for those exceeding the monthly minimum requirement.

No Contract Complaints

There have been no discovered complaints regarding Moolah’s rates or fees, indicating a general merchant satisfaction with their service terms. For those with firsthand experience or specific details about Moolah’s contracts, your insights are welcome in the comments section below this review.

Moolah Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Employs Independent Resellers | No |

|---|---|

| Advertises Deceptive Rates | No |

| Discloses All Important Terms | Yes |

In-House Sales Team

Moolah appears to primarily market its services via strategic partnerships and traditional advertising. There is no indication at this time that the company employs a large number of independently contracted sales agents, and we cannot find any Moolah reviews that mention unethical conduct by company representatives. If you suspect that Moolah is charging you hidden fees, we recommend seeking a third-party statement audit.

Clearly Listed Rates

Moolah advertises a flat rate of 2.69% plus $0.29 for all transactions as well as three possible monthly minimum Moolah fees, and these costs appear to be accurately quoted. In light of the company’s total disclosure, we have given the company an “A” rating in this category.

Our Moolah Review Summary

Our Final Thoughts

Moolah is recognized as a reliable merchant services provider based on available information. The company’s per-transaction pricing is marginally more affordable than industry averages, and it’s notable that it has only garnered two complaints across consumer protection websites. While this is encouraging, merchants evaluating Moolah for in-store payments should compare its offerings with those of top-rated mobile processors to see if cost savings can be found elsewhere. Our overall rating of Moolah remains subject to change once the Better Business Bureau establishes a profile for the company, providing further insight into its performance and customer satisfaction.

Location & Ownership

Moolah is a registered ISO/MSP of Central Bank of St. Louis, Clayton, MO, and is headquartered at 34700 Pacific Coast Highway, Suite 200, Capistrano Beach, California 92624. Darrin Ginsberg, Mark Rasmussen, and Kevin Weel are the managing partners of Moolah.

If you found this article helpful, please share it!

Mark Hutchins

OK…just signed with these people and had a very pleasant interaction. Quick, easy and friendly. My last transactor was always giving me problems. So far, really happy.

CPO

Hi Mark,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

steve

on our first call with Moolah, the customer service team was bad.