Overview

In this review of Kibopay, we’ll provide an overview of the company’s merchant services and examine the potential risks and controversies surrounding its operations. We will also investigate Kibopay’s partnerships for payment processing hardware and POS systems. Customer reviews and third-party ratings of Kibopay will also be covered in detail to provide a window into customer satisfaction. Our goal is to provide a balanced review, highlighting both the strengths and potential pitfalls of working with Kibopay, to provide insights needed to make an informed decision.

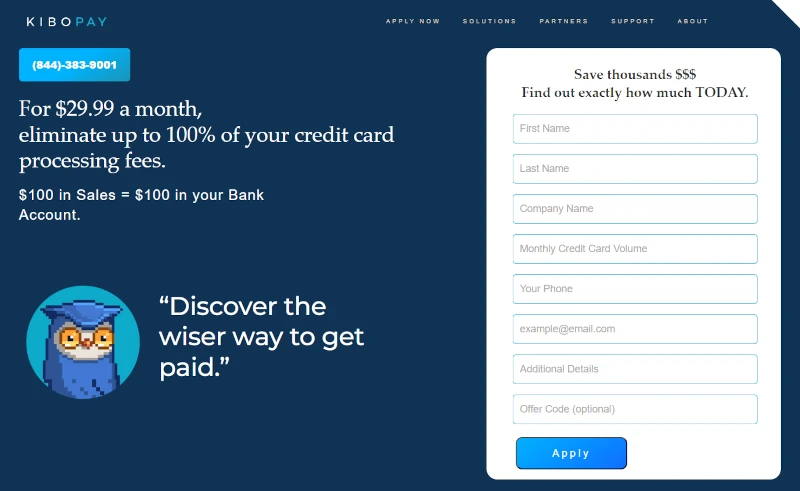

About Kibopay

Kibopay markets merchant accounts, mainly promoting a surcharge pricing model, also known as “dual pricing” or “cash discount” pricing. This model shifts credit card transaction fees to customers, eliminating processing costs for businesses. We’ll explore the pricing and risks associated with Kibopay’s surcharge model later in this article.

Relationship with Merchant Lynx

Evidence suggest Kibopay resells services for Merchant Lynx, which would mean businesses receive payment processing through Paysafe. Both Paysafe and Merchant Lynx have numerous complaints about service quality and customer support. Although unconfirmed, online reviews from unhappy customers claim Kibopay is partnered with Merchant Lynx.

Evidence Supporting Reseller Theory

Further evidence supporting this reseller theory includes:

- Kibopay is not listed on Visa’s approved service provider registry.

- The company doesn’t disclose its processing bank on its website, unlike standard industry practice.

Affiliated Businesses

Kibopay’s founders also operate a merchant cash advance business, Cash Bouy, Inc. Other affiliated entities include:

- Kibo Cash

- Kibo Merchant Solutions

- Kibo Pay

Unrelated Entity

Note that Kibo Commerce, a similarly named company, appears unrelated to Kibopay or its founders.

Chris

Kibo pay is passing the 3.75% CC processing fee onto the customer. Your customers may decide to divorce you!